Pubs to be proud of

To bring people together to create happy, memorable, meaningful experiences.

Find a Marston's pub

With our pubs all over the UK, for all occasions, chance is there is probably one in your area, so find your local here.

Work for us

Looking for a role that offers more? Whether it’s a management or team member role in our pubs, a head office role across our pub support centre teams, or early career opportunities – we’ll help you find your perfect job.

Work with us

Have you always wanted to be your own boss? Free your ambition and run a pub in partnership with Marston’s. We have a range of agreements and opportunities available across England and Wales.

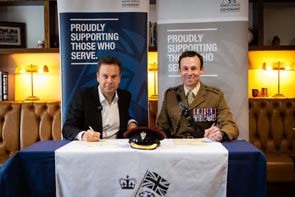

News and updates

View all our up-to-the-minute news from Marston’s PLC